Construction Materials Prices Flat in March

Summary

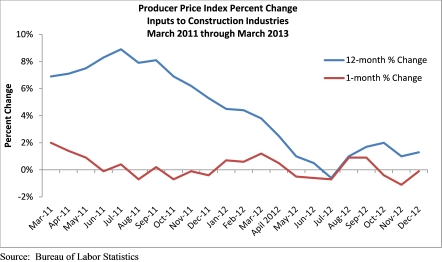

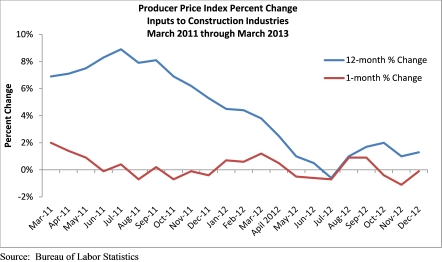

National construction materials prices were flat in March and are 0.9 percent higher year over year, according to the Labor Department’s April 12 Producer Price Index report. Nonresidential construction materials prices slipped 0.2 percent for the month, but are up 0.2 percent compared to one year ago.

Softwood lumber prices jumped 4.4 percent for the month and are 30.1 percent higher from one year ago. Prices for nonferrous wire and cable increased by 2.2 percent in March, but remain 1.8 percent lower from last March. Iron and steel prices increased 1.4 percent, but are down 9.4 percent on a year-over-year basis. Prices for prepared asphalt, tar roofing and siding were up 0.3 percent for the month and are 8.6 percent higher than one year ago. Concrete product prices inched up 0.1 percent in March and are up 2.1 percent over the past twelve months.

In contrast, crude energy materials fell 8.5 percent in March, largely driven by a drop in crude petroleum prices, and are down 14.1 percent for the month. Year over year, prices for crude energy materials are down 1.9 percent. Steel mill product prices decreased 0.4 percent for the month and are 9.5 percent lower than one year ago. Prices for plumbing fixtures and fittings slipped 0.3 percent in March, but are 1 percent higher from the same time last year. Prices for fabricated structural metal products dipped 0.3 percent from the previous month and are down 0.2 percent on a year-over-year basis.

Overall, the nation’s wholesale goods prices decreased 0.6 percent in March, but are 1.1 percent higher than the same time last year.

Analysis

“On the surface, it appears construction materials prices were well behaved in March,” said Associated Builders and Contractors Chief Economist Anirban Basu. “However, ABC has been warning for several months about materials cost volatility due to a variety of forces, including faster global economic growth and significant shifts in currency values and exchange rates.

“Below the headline numbers, there is significant volatility in several key materials segments,” remarked Basu. “For example, the rapid price increases of softwood lumber, along with iron and steel products, exhibited volatility.

“Nonresidential prices would have risen for the month, but for the decline in petroleum prices,” Basu stated. “In other words, there was volatility in the construction materials prices, but the steep decline in petroleum prices offset the increase in other categories.

“ABC anticipates growing construction materials price volatility for much of this year,” declared Basu. “The general expectation is that construction materials prices will increase, due to overall rising asset prices in the local economy.”

National construction materials prices were flat in March and are 0.9 percent higher year over year, according to the Labor Department’s April 12 Producer Price Index report. Nonresidential construction materials prices slipped 0.2 percent for the month, but are up 0.2 percent compared to one year ago.

Softwood lumber prices jumped 4.4 percent for the month and are 30.1 percent higher from one year ago. Prices for nonferrous wire and cable increased by 2.2 percent in March, but remain 1.8 percent lower from last March. Iron and steel prices increased 1.4 percent, but are down 9.4 percent on a year-over-year basis. Prices for prepared asphalt, tar roofing and siding were up 0.3 percent for the month and are 8.6 percent higher than one year ago. Concrete product prices inched up 0.1 percent in March and are up 2.1 percent over the past twelve months.

In contrast, crude energy materials fell 8.5 percent in March, largely driven by a drop in crude petroleum prices, and are down 14.1 percent for the month. Year over year, prices for crude energy materials are down 1.9 percent. Steel mill product prices decreased 0.4 percent for the month and are 9.5 percent lower than one year ago. Prices for plumbing fixtures and fittings slipped 0.3 percent in March, but are 1 percent higher from the same time last year. Prices for fabricated structural metal products dipped 0.3 percent from the previous month and are down 0.2 percent on a year-over-year basis.

Overall, the nation’s wholesale goods prices decreased 0.6 percent in March, but are 1.1 percent higher than the same time last year.

Analysis

“On the surface, it appears construction materials prices were well behaved in March,” said Associated Builders and Contractors Chief Economist Anirban Basu. “However, ABC has been warning for several months about materials cost volatility due to a variety of forces, including faster global economic growth and significant shifts in currency values and exchange rates.

“Below the headline numbers, there is significant volatility in several key materials segments,” remarked Basu. “For example, the rapid price increases of softwood lumber, along with iron and steel products, exhibited volatility.

“Nonresidential prices would have risen for the month, but for the decline in petroleum prices,” Basu stated. “In other words, there was volatility in the construction materials prices, but the steep decline in petroleum prices offset the increase in other categories.

“ABC anticipates growing construction materials price volatility for much of this year,” declared Basu. “The general expectation is that construction materials prices will increase, due to overall rising asset prices in the local economy.”