Nonresidential Construction Loses Jobs in January, Says ABC

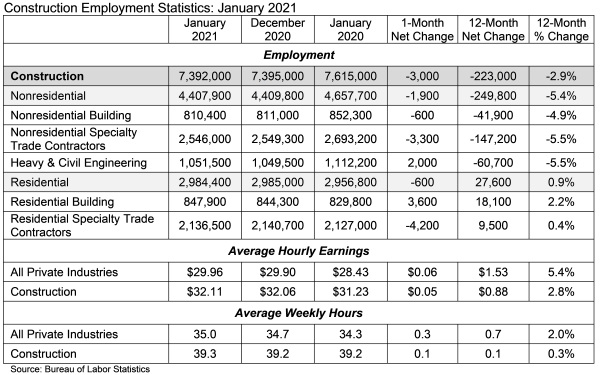

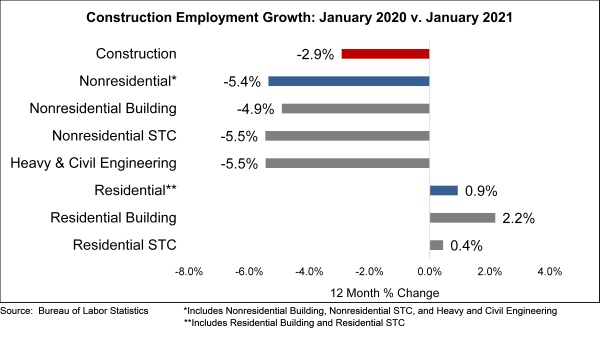

WASHINGTON, Feb. 5—The construction industry lost 3,000 jobs on net in January 2021, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. During the last nine months, the industry has added 857,000 jobs, recovering 77% of the jobs lost during earlier pandemic stages.

Nonresidential construction employment fell by 1,900 jobs on net in January. Heavy and civil engineering added 2,000 jobs for the month, but those gains were offset by losses in nonresidential specialty trade and nonresidential building, which lost 3,300 and 600 jobs, respectively.

The construction unemployment rate declined to 9.4% in January and is up 4 percentage points from the same time last year. Unemployment across all industries fell from 6.7% in December 2020 to 6.3% last month.

“Multiple forces are shaping nonresidential construction market dynamics, with the result that industry employment has flatlined,” said ABC Chief Economist Anirban Basu. “The construction industry began the COVID-19 crisis with significant backlog, according to ABC’s Construction Backlog Indicator. This industry also has the enviable status of an essential industry in America. That pre-existing strength in a number of public construction segments continues to translate into demand for workers.

“Not coincidentally, heavy and civil engineering, which encompasses road building and similarly situated segments, added jobs in January, said Basu. “At the same time, commercial real estate fundamentals have been hammered during the crisis by online sales and remote work. These factors have reduced demand for construction services in office, lodging and other commercial segments, especially with respect to new construction. Last month, this translated into fewer jobs in both the nonresidential building and specialty trade categories.

“Given the damage to many state and local government balance sheets, public construction spending is set to weaken going forward in conjunction with a number of key private segments,” said Basu. “That said, there are some areas of current and prospective strength, including fulfillment centers, data centers, manufacturing facilities and healthcare. But much of the industry’s fortunes during the balance of 2021 and into 2022 will depend on policymakers in Washington and their ability to deliver on their commitment to expanding the capabilities of the nation’s infrastructure. Absent a federal infusion of significant and much-needed investment, nonresidential construction is poised to be one of the weaker economic segments in terms of pace of recovery going forward.”